jersey city property tax abatement

Jersey City Public School which educates about 30000 students at its peak received 4187 million in state aid for the 2016-2017 school year but it will have seen more than 2336 million. You can also visit the New Jersey Division of Taxation Local Property Tax Forms page where you will find forms for a variety of different property tax related needs.

How To Calculate 421a Tax Abatement Savings On A Nyc Condo

New Jersey allows corporations to carry forward losses from prior years.

. New jersey property tax system legend building description format. Taxes for multi-state corporations are apportioned using a three-factor formula of sales property and payroll. 1 12 story stone limited exemptions code explanation colonial 2 car attached garage exempt property class codes deductions code explanation taxable property railroad property personal property class codes.

The Tax Assessors Office is responsible for the establishment and maintenance of real property values within the city. It is located adjacent to the Trump Plaza apartment tower which was completed in 2008. New Jersey has research and development credits capped at 50 of tax liability.

Its one of the best investments for many reasons and it could be one of the biggest financial decisions you could make in your life. In New Jersey this apportionment is weighted at 502525. If you have any plans of living abroad it.

The official website of City of Union City NJ. Your property tax bill is based on the assessed value of your property any exemptions for which you qualify and a property tax rate. 1 Shore Ln APT 1609 Jersey City NJ is a apartment home that contains 780 sq ft and was built in 2008.

Property Tax Abatement in Ohio. A second Trump Plaza tower had initially been planned but was delayed and the property for the proposed building was sold several times during the Great. New Jersey imposes a 150 per partner filing fee capped at 250000 for every partnership filing a.

Trump Bay Street is a 50-story apartment tower named after Donald Trump and located at 65 Bay Street in Jersey City New Jersey. We Value Kearny New Jerseys real property tax is Ad Valorem or a tax according to the value. The Division also administers the citys residential abatement program.

When searching choose only. It contains 1 bedroom and 1 bathroom. Section 544-825 - Property tax deferment for certain persons in military service Section 544-826 - Written application for tax deferral.

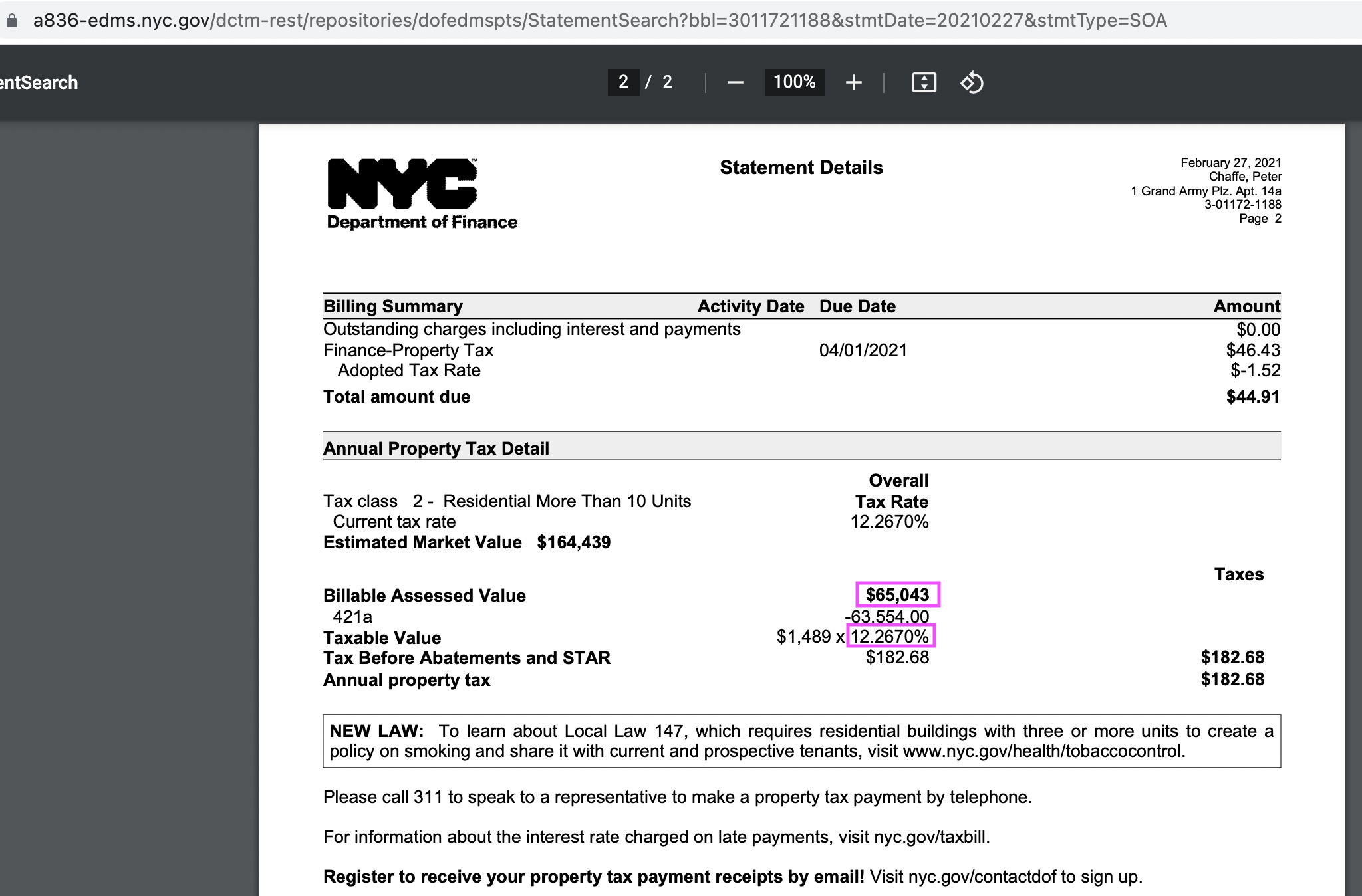

Nothing is more fulfilling than having your own property. Tax foreclosure particularly in municipalities where property values are low and many owners see no compelling reason to continue to pay taxes on vacant or substandard properties is the means by which most abandoned properties fall into a municipalitys hands. Its a city-run property tax abatement program for co-ops and condos designed to ease the burden of qualified units taxes.

Madison County Property Tax Inquiry. The Rent Zestimate for this home is 2849mo which has increased by 2849mo in the last 30 days. All values are determined by inspection of the site in question and established per rules set forth by the State of New Jersey.

Find news and information about our government and learn more about our programs and services. Tax lien during deferment prohibited Section 544-827 - State payment to municipality refund upon payment. The program can be beneficial if you bought a home in the 421a program and the exemption is about to expire.

Homeowners in Florida receive a 25000 property tax exemption for their home and an additional 25000 exemption from non-school taxes. Under the program certain improvements which add value to a home including additions decks sheds or extra bathrooms are eligible for property. Your property tax assessment is determined on a certain date.

The city of Cleveland temporarily eliminates 100 of the increase in real estate tax of a property when the homeowners remodel or convert it into a two-family or multifamily home. On February 28 2022 the New Jersey Division of Taxation filed its response to Ferrellgas Partners LPs petition for a writ of certiorari challenging New Jerseys imposition of an unapportioned per-partner filing fee imposed on partnerships filing tax returns in the state. To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site address.

How To Calculate 421a Tax Abatement Savings On A Nyc Condo

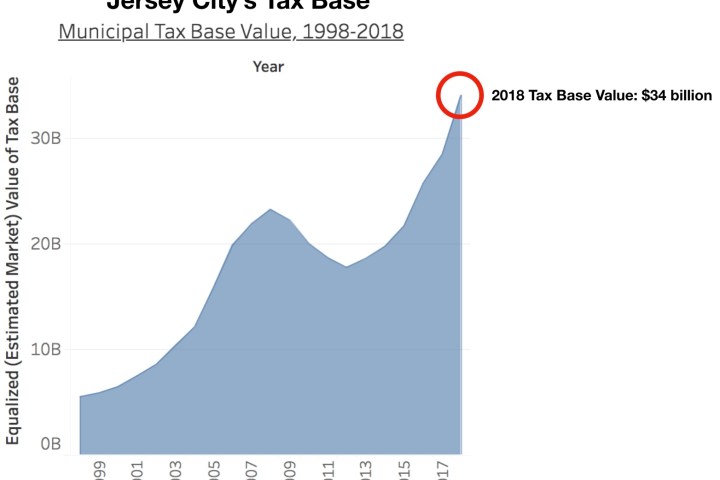

Jersey City Public Schools Funding Crisis Civic Parent

Form Recognizer Icon The Ten Secrets That You Shouldn T Know About Form Recognizer Icon Context Ten Gender Identity

Jersey City Public Schools Funding Crisis Civic Parent

One West End At 1 West End Ave In Lincoln Square 29th Floor City Living Apartment Floor Plans Apartment Penthouse

Jersey City Public Schools Funding Crisis Civic Parent

Abatements 801 We Need Better Abatement Disclosures In Nj To Show Impact On Public Schools Civic Parent

Abatements 801 We Need Better Abatement Disclosures In Nj To Show Impact On Public Schools Civic Parent

Property Tax Comparison By State For Cross State Businesses

Has Steve Fulop Evolved On Tax Abatements Steve Evolve Tax

Jersey City To Audit Tax Abatement Deals To Help Fill School Funding Gap Hudson Reporter

Jersey City Public Schools Funding Crisis Civic Parent

One Theater Square Tower Rises Rapidly On Newark Skyline Newark Skyline Tower

Jersey City Public Schools Funding Crisis Civic Parent

Top Project By Drake Anderson Bedroom Interior Luxurious Bedrooms Bedroom Decor

Jersey City Public Schools Funding Crisis Civic Parent

New Offshore Tax Haven Report Offshore Tax Haven Tax

New Jersey New Homes For Sale Https Www Pinterest Com Njestates1 Nj New Homes For Sale Thanks To Http Www N New Homes Luxury Real Estate Real Estate Nj